Rapid changes in laws and regulations (covid test requirement for companies, import/export restriction, etc.) force you as a business owner to quickly introduce and implement measures. In parallel, measures have to be taken due to the economic situation in order to secure the earnings situation. In our tutorial, you’ll learn how to capture risk, take and track action quickly through early risk detection, and achieve comprehensive, real-time reporting via dashboards.

Covid-19 has shown the business community the disadvantages of global economic chains: restricted mobility of goods and people due to closed borders, drastic slumps in the economy up to the complete standstill of individual economic sectors. At the same time, government support for individual sectors of the economy, in conjunction with the suspension of bankruptcy, encourages the creation and expansion of zombie firms.

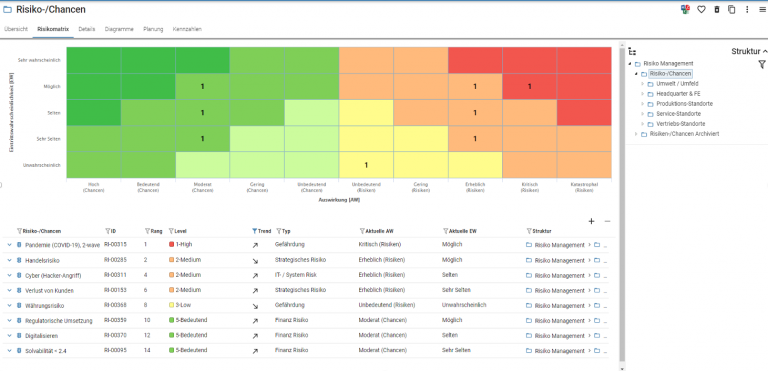

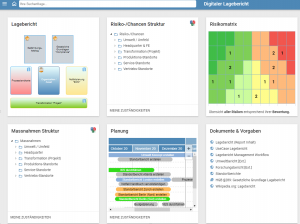

Risk management is therefore more topical than ever. Operational risk (OpRisk) management, e.g. supply chain risk, and counterparty risk management in the context of the zombification of the economy are key components of corporate governance. In addition, active management of financial risks is needed to assess the financial impact of the pandemic. Measures are defined for the secure control of the company and applied to individual parts of the company or organizational units. Real-time reporting and dashboards allow management to track implementation status and success in terms of mitigated risks at any time – without the need for time-consuming physical reports.

The area of cyber risk poses enormous challenges for companies:

Defending against scam or ransomware attacks requires continuous assessment of current external risks and taking action in the cyber domain. In addition to the external risks, there are internal risks from data breaches, which are exacerbated in particular by the current home office situation. TopEase helps you evaluate how effectively you are securing your home office workstations and sensitive information, and measurably mitigating your risks.

In addition, there is an increasing number of regulatory requirements for the cyber sector that must be met by companies. With TopEase, not only can the effects of regulation be evaluated operationally and financially, but the implementation of the measures can also be documented in an audit-proof manner. We support e.g. the complete risk management according to ISO 27000 in the area of information security.

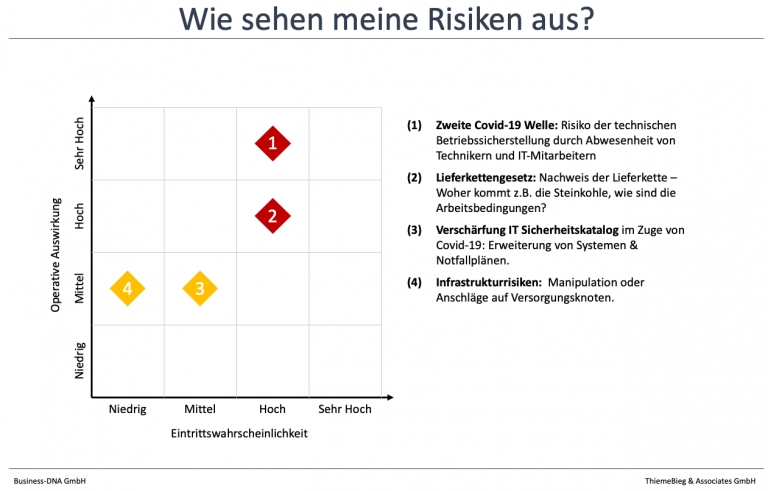

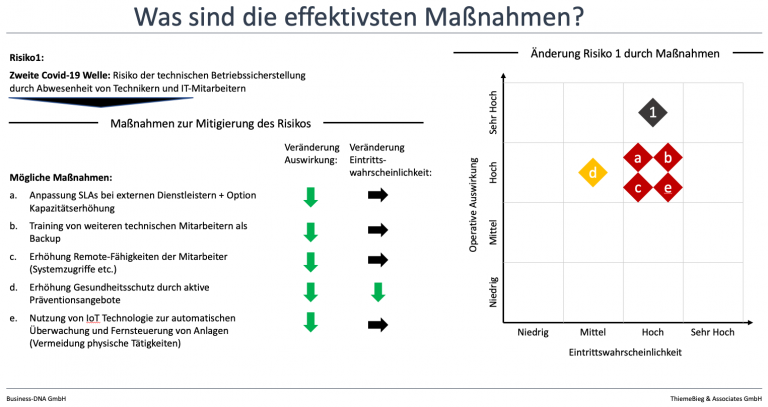

For our customers, the pandemic poses significant financial and operational risks due to regulatory requirements, in addition to the direct risks of lost sales markets, employee absences, and supply chain restrictions:

For our customers, the pandemic poses significant financial and operational risks due to regulatory requirements, in addition to the direct risks of lost sales markets, employee absences, and supply chain restrictions:

We support companies with the TopEase software platform in particular with the following challenges:

A majority of companies and public enterprises are currently not yet dealing with the assessment of pandemic consequential risks. Current government support will be phased out, mandatory bankruptcy will be reinstated for the foreseeable future, and digitalization in the wake of the pandemic will vsl. remain in place. How does this affect companies and public enterprises?

Some of the public utilities already had significant renovation backlogs prior to Covid-19, particularly in the pool operations area. What consequences do shrinking commercial revenues in cities and towns have on municipal businesses or cultural venues? How are the risks assessed and what room for maneuver remains with the municipalities and municipal enterprises?

In addition, we see considerable consequential risks for owners and operators of commercial real estate. Should the home office arrangement remain in place for some of the employees in the longer term, the need for office space will decrease. Companies must also analyze the new mobility of employees due to the elimination of location-based working from a risk perspective – increasing turnover requires new measures to retain remote employees.

With risk management on the TopEase platform, we offer a tool for comprehensive analysis and evaluation of consequential risks and support our customers in the introduction and implementation of pandemic follow-up measures.

The main problem our customers face is internal capacity in risk management. The main problem of our customersThe increased legal requirements, especially for complex business impact analyses (BIA) and the creation of far-reaching contingency plans involving the complex and evolved IT architectures are currently the greatest challenges. represents the internal capacity in risk management.

A current issue is the impact of COVID-19 on ensuring the operation of key systems – can they be operated entirely from the home office? Often, additional head monopolies prevail here, and it is not uncommon for the core systems of the critical infrastructure in finance and insurance, but also in energy utilities, to be mainframe systems without sufficient documentation of the processes and interfaces. How should this be handled?

No more long search for information. No Powerpoints or Excel solutions to consolidate across multiple divisions, locations or companies. Our risk overview in the digital management report shows you at a glance where you stand – and your need for action.

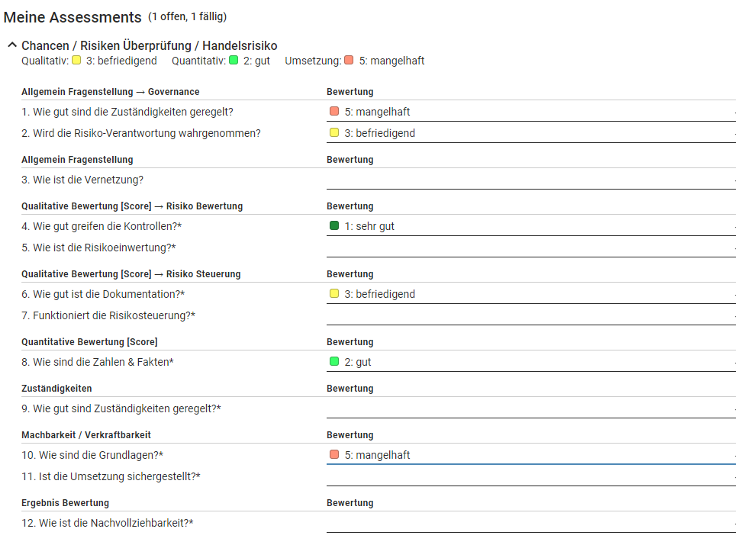

Use self-assessments to manage complex transformations: From the new construction of the IT landscape, the introduction of systems, the spin-off of company parts to the introduction of new business models.

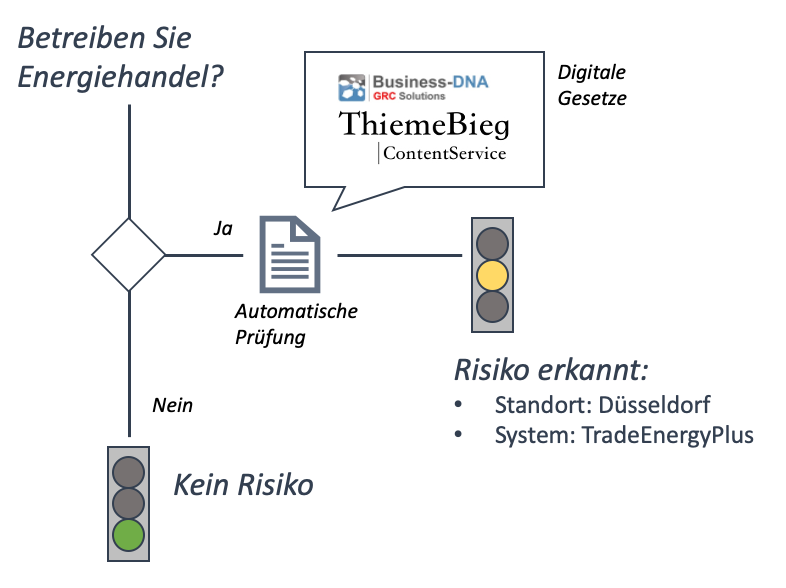

Everyone is equal before the law – but everyone digitizes the laws themselves. With the ContentService for TopEase, you can save yourself this workload – you receive regular updates on relevant laws and regulations.