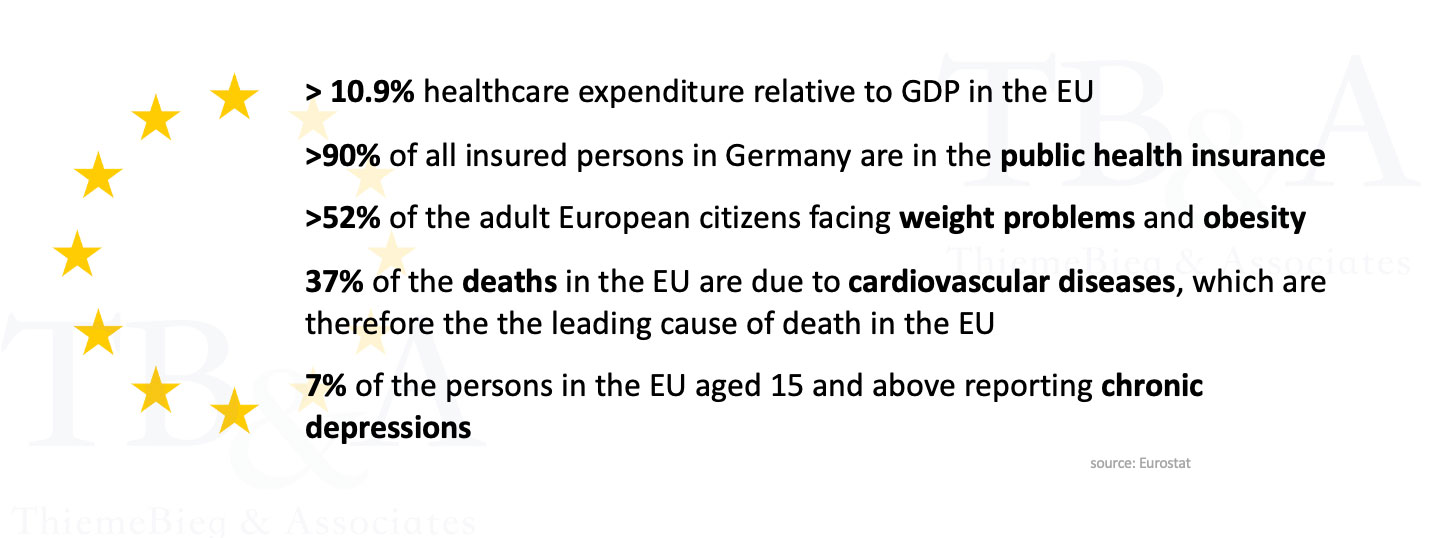

The European healthcare market can be a lucrative market to enter:

First, healthcare providers and medical device manufacturers acting in Europe benefiting from the universal access to healthcare for EU citizens (=demand side). This differs mainly from other markets such as the US. This means a steady and robust demand for health services all over Europe. From a supply side perspective, the EU Medical Device Regulation (MDR) enables to market medical products all over the EU with just one certification.

Second, Europe has an aging population with a high prevalence of chronic conditions. This demographic shift has led to an increase in demand for specialized care, creating new opportunities especially for companies in digital healthcare as the care home sector is poorly digitized.

Third, many European countries have public health insurance systems that cover a significant portion of healthcare costs. This means that patients are more likely to seek medical attention when they need it, creating a steady stream of revenue for healthcare and medical product providers.

Short overview of the most common market barriers into the European healthcare market:

The European Union has different regulations and requirements for healthcare providers than the US. US healthcare providers must ensure that they meet all the necessary regulatory standards, which can be a complicated and time-consuming process. Non-compliance may lead to an intermediate removal of the product from the market. For medical product manufacturers, the major challenge is the constant compliance with the European Medical Device Regulation (MDR / Regulation: EU 2017/45), the European equivalent of the FDA approval. The MDR approval consists of several parts, naming a view: General company setup in terms of Governance, Risk and Compliance with GRC disciplines like information security and process management according to ISO and national standards, medical risk management, clinical data gathering and clinical trials, post-market surveillance and others. ThiemeBieg’s key competence is the setup and maintenance of the GRC requirements, the maintenance of the GRC systems and processes as well as the preparation and support during audits (i.e. for public health reimbursement and maintaining other certifications).

Especially for US based companies the compliance with the European data protection directive GDPR is a major challenge and often a dealbreaker for entering the US market:

One of the major differences between GDPR and HIPAA is their scope. GDPR applies to any organization that processes the personal data of EU citizens, regardless of where that organization is located. Further, the data can’t be processed and in the majority of cases not even accessed from outside of the EU. HIPAA, on the other hand, only applies to covered entities such as healthcare providers, health plans, and healthcare clearinghouses in the United States. Another difference between the two regulations is the level of consent required for data processing. GDPR requires explicit consent from individuals before their personal data can be processed, while HIPAA only requires covered entities to obtain a patient’s consent for certain types of PHI disclosures. GDPR also places a stronger emphasis on individual rights than HIPAA. Under GDPR, individuals have the right to access, correct, and erase their personal data. HIPAA grants patients the right to access and amend their PHI, but does not include a right to be forgotten. In terms of penalties for noncompliance, GDPR has much higher fines than HIPAA. GDPR can impose fines of up to €20 million or 4% of global annual revenue, while HIPAA fines are limited to a maximum of $1.5 million per year.

Further, national regulations such as the DSGVO in Germany or the FDPA implementation in France having additions and derogations to the EU-GDPR. To make it more complicated – German law gave the 16 states the power to define further guidelines and requirements on state-level which are applicable to all companies registered in a specific state.

With our experience in data protection for medical product manufacturers, ThiemeBieg can help to identify the relevant and applicable laws, and suggest an implementation plan to comply with the federal and state-level requirements. Further, we have experience in dealing with data protection requirements from the public health insurance system.

Healthcare reimbursement systems in Europe can differ significantly from those in the US. US providers need to navigate the complex and diverse reimbursement systems of each country they wish to enter. In contrary to the US, there exists not “payvidors”, as payors and providers are different legal entities with different interests. Public insurances as well as national associations or interest groups (such as the German ‘kassenärztliche Bundesvereinigung’) are able to create additional regulatory requirements which have to be met for the reimbursement of services and medical products.

The European healthcare market is highly competitive, with established providers and numerous domestic players. US healthcare providers must have a competitive advantage to differentiate themselves and establish a strong foothold in the market. As a large stake of European healthcare companies focussing on physical products, especially digital health solutions out of the US could be interesting for the European market.

Europe has over 50 different countries, each with its own language and dialect. US healthcare providers must be able to communicate effectively with patients and healthcare professionals in the local language. Especially the key players in the market, such as the national health insurances acting local in just one country, and are not used to speak anything else then the local language. Bringing new products into the European market can be a long-lasting approach, containing lengthy negotiations, often monthlong trials with several insurances to create clinical evidence for the product usage, negotiations with doctor unions and so on. The process into the lucrative public health system can be ways more challenging than in other countries. Especially US healthcare providers need to understand these differences and adapt their practices to meet the unique needs of European patients and healthcare providers / insurances.

Our approach is based on our experience in working with clients part of the critical infrastructure and healthcare industry in Europe. After the definition of the regulatory challenge (i.e., market entry, solving regulatory findings and non-compliances) we conduct a structured assessment of the as-is situation of the company. The outcomes are a risk assessment, corresponding mitigation measures and an implementation roadmap to solve the regulatory challenge.

The challenge can mainly be solved by implementing and following relevant ISO standards such as ISO 22301 (BCMS), ISO 27000 (ISMS), ISO 13485 (QMS), ISO 14971 (Medical RMS), European Standards (EU MDR, EU GDPR), or national Standards as NIST in US, BSI Grundschutz in Germany.

The process is mainly conducted via our asset-based consulting approach, leveraging our own tools, and using the software platform TopEase® to close the regulatory gaps.

Healthcare companies are attractive targets for cybercrime as they handle a significant amount of sensitive data, such as patient health information. We support healthcare companies in protecting this data from unauthorized access, theft, or misuse with the implementation of a robust information security management system (ISMS), following and combining standards such as ISO27001 or NIST.

It’s important to prepare for and responding to social, economic and technical risks which affecting the operability of a healthcare provider in a dynamic environment. Our business continuity management (BCMS) solution includes, among others, a full business impact analysis including dependency analysis, availability risk assessments, and emergency planning. The solution can be connected to alarming systems or third-party process and asset management solutions.

Healthcare companies often rely on third-party vendors and service providers, such as cloud providers and electronic health record (EHR) systems, to manage and store patient data. Ensuring that these vendors have adequate security and quality measures in place can be challenging, particularly for smaller companies with limited resources. We provide a software solution including digital frameworks for third party supplier risk management and supplier compliance which fits for all company sizes and requirements.